Open the Perks: Offshore Trust Solutions Discussed by an Offshore Trustee

Offshore trust fund services have actually ended up being progressively preferred among people and organizations seeking to enhance their financial approaches. In this insightful overview, we explore the world of overseas trust funds, offering a thorough understanding of their advantages and just how they can be successfully made use of. Created by an overseas trustee with years of experience in the field, this source offers useful insights and expert recommendations. From the essentials of overseas trust funds to the details of tax obligation preparation and possession defense, this overview checks out the numerous advantages they offer, consisting of improved personal privacy and discretion, flexibility and control in wealth administration, and access to worldwide investment opportunities. Whether you are a seasoned financier or new to the concept of offshore counts on, this guide will certainly equip you with the knowledge needed to open the advantages of these powerful monetary tools.

The Fundamentals of Offshore Trust Funds

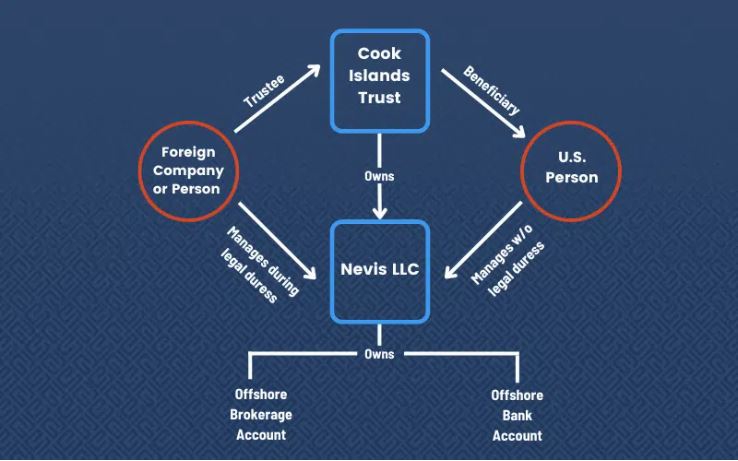

The fundamentals of offshore depends on entail the facility and administration of a rely on a jurisdiction outside of one's home country. Offshore trust funds are often used for property defense, estate preparation, and tax optimization purposes. By putting properties in a count on situated in an international jurisdiction, individuals can ensure their possessions are protected from potential dangers and obligations in their home nation.

Establishing an overseas trust fund generally calls for involving the services of a specialist trustee or depend on business who is fluent in the legislations and regulations of the selected territory. The trustee acts as the lawful owner of the assets kept in the depend on while managing them according to the terms set out in the trust fund act. offshore trustee. This setup gives an included layer of security for the possessions, as they are held by an independent 3rd celebration

Offshore trust funds use a number of advantages. They can provide boosted privacy, as the details of the trust fund and its beneficiaries are normally not publicly revealed. Secondly, they provide potential tax obligation benefits, as particular territories might have a lot more desirable tax routines or offer tax exceptions on certain sorts of income or possessions kept in trust fund. Finally, offshore counts on can help with effective estate preparation, enabling individuals to hand down their riches to future generations while lessening inheritance tax responsibilities.

Tax Planning and Property Protection

Tax obligation preparation and property protection play a critical duty in the calculated use of overseas trusts. Offshore trusts offer individuals and businesses with the chance to decrease their tax liabilities legally while protecting their properties. Among the primary advantages of utilizing overseas trusts for tax obligation planning is the ability to make the most of beneficial tax programs in international territories. These jurisdictions typically offer reduced or absolutely no tax rates on specific kinds of earnings, such as capital gains or rewards. By establishing an overseas trust fund in among these services, territories and individuals can considerably minimize their tax worry.

By moving possessions into an offshore trust, individuals can secure their wealth from prospective lawful insurance claims and guarantee its conservation for future generations. In addition, overseas depends on can provide privacy and personal privacy, additional shielding assets from prying eyes.

Nonetheless, it is necessary to keep in mind that tax obligation preparation and property defense should constantly be conducted within the bounds of the regulation. Participating in unlawful tax evasion or illegal property security strategies can lead to extreme consequences, including penalties, penalties, and damage to one's credibility. As a result, it is vital to look for specialist advice from knowledgeable offshore trustees who can lead individuals and businesses in structuring their offshore rely on a honest and compliant way.

Enhanced Privacy and Discretion

When utilizing overseas depend on services,Enhancing privacy and confidentiality is a paramount objective. Offshore depends on are renowned for the high degree of personal privacy and discretion they supply, making them an attractive choice for people and companies looking Click Here for to shield their possessions and financial details. One of the key advantages of overseas trust fund services is that they supply a legal framework that enables people to keep their economic affairs private and secured from spying eyes.

The enhanced personal privacy and discretion offered by overseas depends on can be specifically helpful for individuals who value their the original source personal privacy, such as high-net-worth people, stars, and experts seeking to safeguard their possessions from prospective claims, lenders, and even family members disagreements. By making use of offshore count on services, individuals can keep a higher level of privacy and confidentiality, allowing them to secure their wide range and economic interests.

Nevertheless, it is vital to keep in mind that while offshore trust funds provide enhanced privacy and confidentiality, they must still adhere to appropriate legislations and policies, including anti-money laundering and tax reporting demands - offshore trustee. It is important to deal with respectable and seasoned legal professionals and overseas trustees that can ensure that all legal responsibilities are met while making the most of the privacy and privacy benefits of offshore count on services

Versatility and Control in Wealth Management

Offshore depends on use a substantial level of versatility and control in wealth monitoring, permitting individuals and organizations to successfully handle their assets while preserving personal privacy and privacy. Among the vital advantages of overseas trusts is the capacity to tailor the trust fund structure to satisfy details demands and objectives. Unlike standard onshore depends on, offshore counts on supply a variety of options for property protection, tax planning, and sequence planning.

With an offshore depend on, individuals and services can have better control over their riches and how it is taken care of. They can pick the territory where the count on is developed, permitting them to make use of beneficial regulations and guidelines. This versatility allows them to maximize their tax obligation position and shield their assets from prospective threats and liabilities.

Furthermore, overseas trust funds offer the option to select professional trustees who have considerable experience in handling complicated counts on and navigating international laws. This not just ensures efficient wide range management yet likewise supplies an extra layer of oversight and safety.

Along with the flexibility and control supplied by overseas depends on, they also give privacy. By holding possessions in an offshore jurisdiction, individuals and businesses can secure their financial info from spying eyes. This can be particularly valuable for high-net-worth individuals and services that worth their privacy.

International Investment Opportunities

International diversification supplies people and organizations with a multitude of financial investment possibilities to increase their portfolios and mitigate dangers. Purchasing worldwide markets enables financiers to access a larger array of property courses, sectors, and geographical areas that might not be offered domestically. By diversifying their investments across different nations, financiers can decrease their direct exposure go to my site to any solitary market or economy, thus spreading their risks.

One of the key benefits of worldwide financial investment opportunities is the possibility for greater returns. Various nations may experience varying financial cycles, and by spending in multiple markets, investors can maximize these cycles and possibly achieve higher returns compared to investing exclusively in their home country. Additionally, investing internationally can likewise supply accessibility to emerging markets that have the possibility for quick economic growth and higher investment returns.

Furthermore, global investment opportunities can give a bush versus currency risk. When buying international currencies, capitalists have the prospective to profit from currency changes. If an investor's home currency deteriorates against the currency of the international investment, the returns on the financial investment can be intensified when transformed back to the financier's home money.

Nonetheless, it is necessary to note that investing internationally additionally features its very own collection of risks. Political instability, governing changes, and geopolitical uncertainties can all influence the efficiency of worldwide financial investments. It is critical for capitalists to perform complete research and seek professional suggestions before venturing into international investment chances.

Conclusion

The fundamentals of offshore trusts include the establishment and administration of a depend on in a jurisdiction outside of one's home nation.Establishing an overseas depend on commonly needs engaging the solutions of an expert trustee or trust fund firm that is skilled in the laws and regulations of the chosen territory (offshore trustee). The trustee acts as the lawful proprietor of the possessions held in the trust while handling them in conformity with the terms established out in the depend on act. One of the vital benefits of overseas trust funds is the ability to customize the trust framework to fulfill specific needs and objectives. Unlike traditional onshore depends on, offshore trusts give a broad variety of alternatives for property security, tax preparation, and succession preparation